For Amazon sellers, the Bulk Invoice Download is one of the extremely useful features in Amazon Seller Central. It provides sellers with the option to download tax invoices from Amazon in bulk for a chosen time period. Amazon has rolled out further enhancements to this feature to be effective from September 3, 2019.

Amazon has already migrated all reports previously downloaded since April 1, 2019, to the new format. However, for the reports downloaded before March 31, 2019, no user history exists anymore. So, if required, sellers can start a new request to download reports for those dates.

Table of Contents

Enhancements in Bulk Invoice Download Feature

- When you select a date range for the invoices, the results will be based on Order Shipping Date. Earlier it was based on Order Placement Date. This is to make the cross-referencing of transactions as reported in MTR/GST reports easier. (MTR: Merchant Tax Report; GST: Goods and Service Tax)

- The Bulk Invoice Zip file will have a cap of 1000 invoices.

- The Bulk Invoice zip file will no longer contain the “successful.txt” and “failed.txt” files. This is because the invoices downloaded will no longer list the failed transactions since date range results are now based on the order shipping date.

- Files within the archives will be renamed to <Invoice_no>_<shipmentId>.pdf for easier ordering.

What are Tax Invoices

Amazon Tax Invoice provides detailed information about the purchase transactions, including the tax breakdown, nature of tax applied against the order, and other details. These invoices help you with your tax reporting and are to be used when filing returns with the tax authorities.

Amazon generates tax invoices for all your customer orders that are Fulfilled by Amazon. You can generate them by printing one by one or use the Buk Invoice Download feature to download them in bulk for a specific date range.

How to bulk download Tax Invoice from Amazon (Step-by-Step)

Follow the below steps to download Amazon Tax Invoice in bulk:

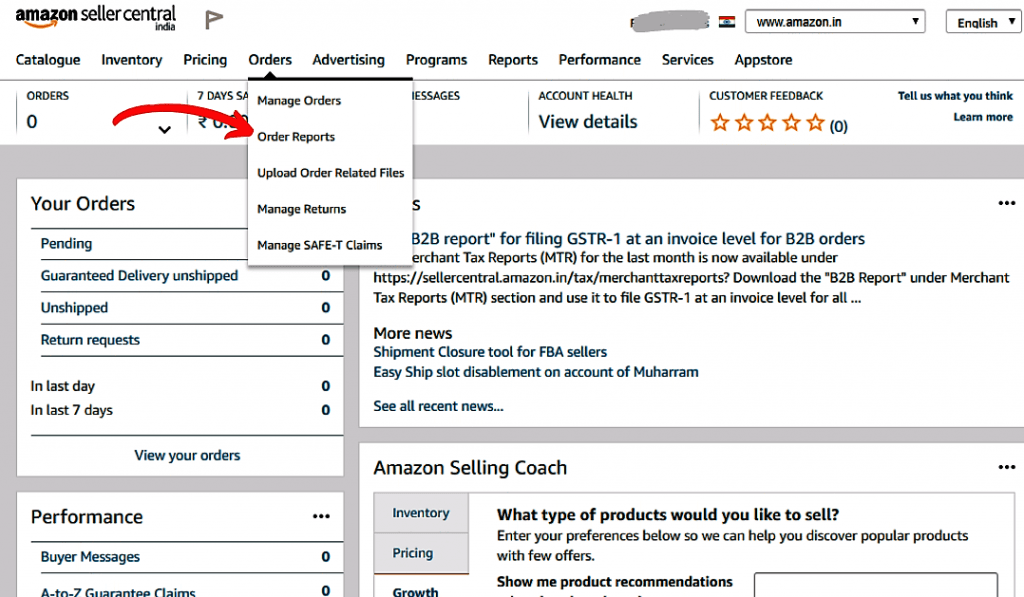

- Click Order Reports under the Orders tab.

Amazon Tax Invoice Bulk Download: Step 1 – Order Reports - Click the Bulk Invoice Download link.

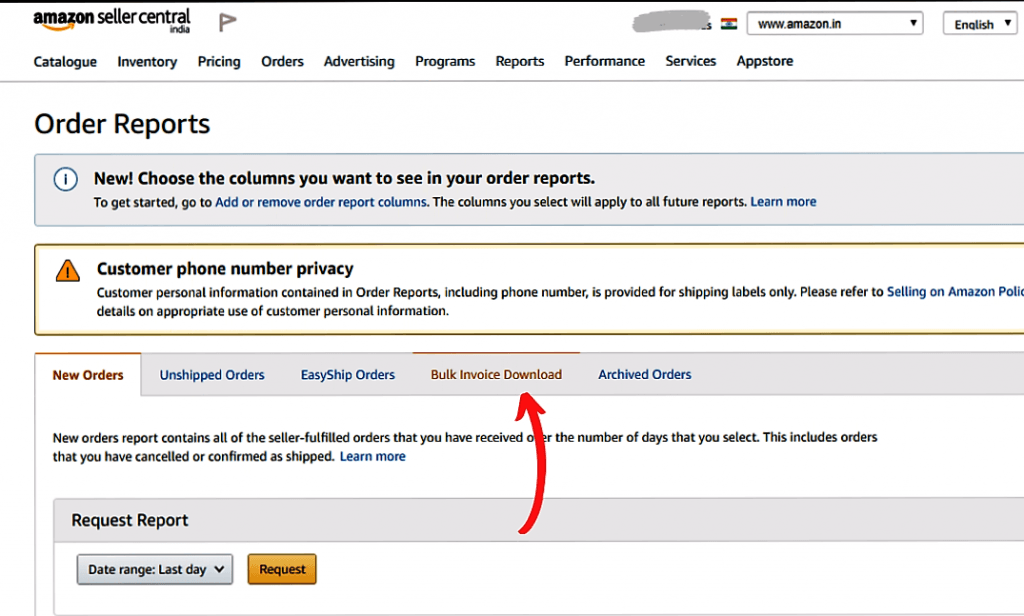

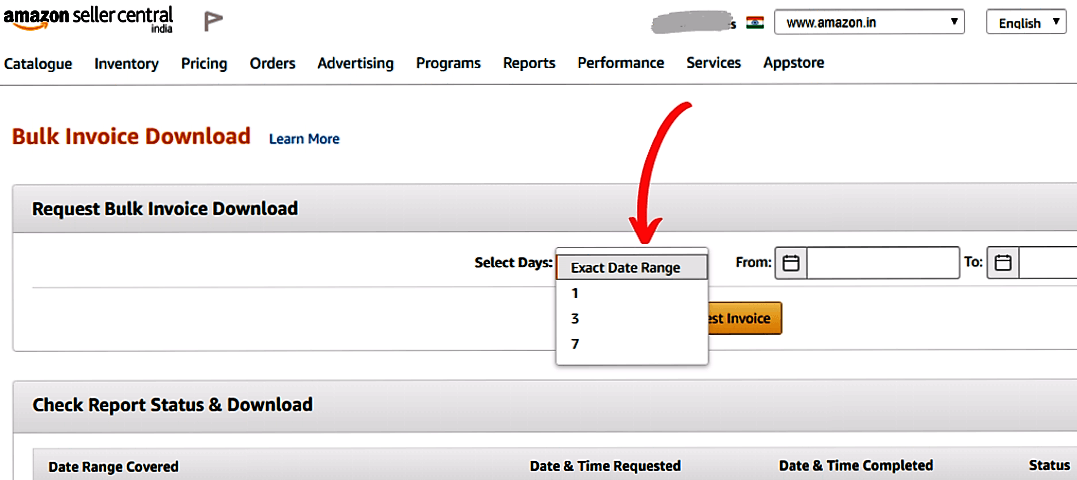

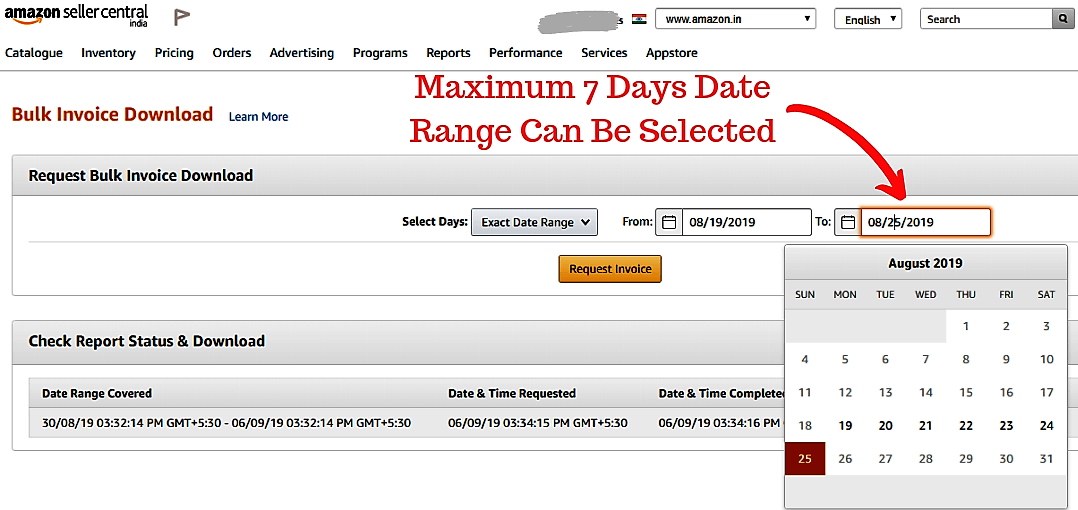

Amazon Tax Invoice Bulk Download: Step 2 – Bulk Invoice Download - From the Select Days drop-down, choose the number of days for which the invoices are to be downloaded (options currently available: 1,3,7 days). Alternatively, you can also select a custom date range for the download using the Calendar Date-Picker.

Amazon Tax Invoice Bulk Download: Step 3a – Select Days

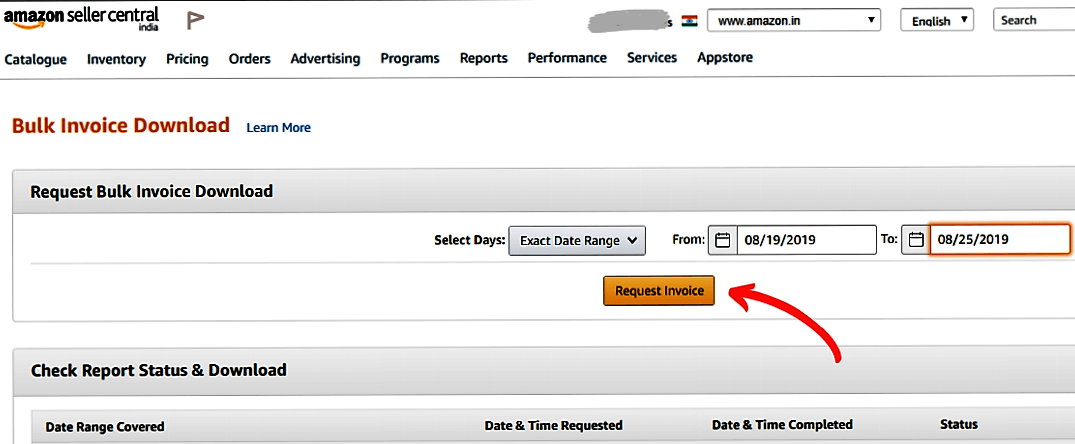

Amazon Tax Invoice Bulk Download: Step 3b – Calendar Date-Picker - After choosing the date range, click on Request Invoices button.

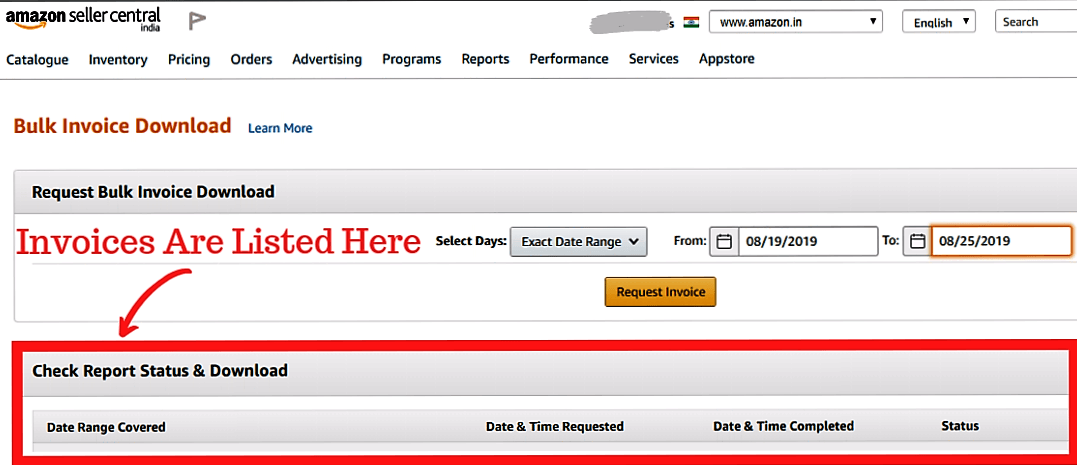

Amazon Tax Invoice Bulk Download: Step 4 – Request Invoices - A status box appears at the top of the page to confirm your request. The report and its production status appear in the Report Status & Download section.

Amazon Tax Invoice Bulk Download: Step 5 – Report Status and Download - You can click the Refresh button to check the download status.

- After the report is ready and available for download, click the Download button for generating a zip file, which will contain all the invoices that have generated during the requested date range.

- If there are no orders that have been completed during the selected date range, the report status will display a message – ‘Zero Orders found’ and ‘No Data Available’ under Download.

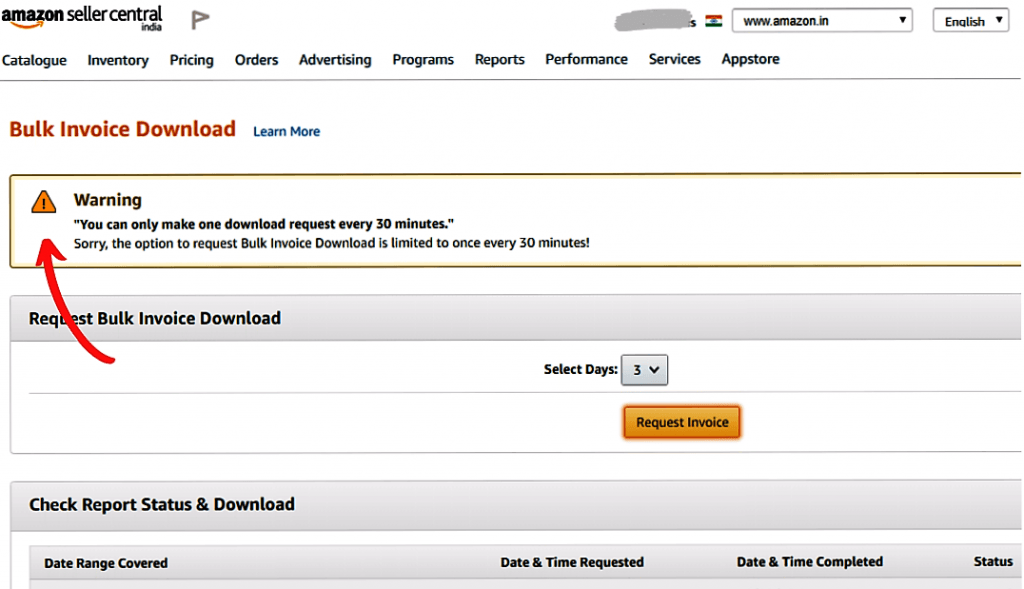

Warning

- You can only request Amazon tax invoice downloads for a maximum of 7 days for any date range.

- Bulk Invoice Downloads can be requested only once every 30 minutes.

Video in Hindi

Timely Updates of Amazon Seller Central Dashboard

Amazon rolls out changes and enhancements to its Seller Central Dashboard Features from time-to-time regularly to improve seller experience.

To get regular updates about Amazon Seller Central Dashboard and other changes, you can subscribe to my Youtube Channel or follow me on Instagram, Facebook or Twitter.

Sharing is Caring! Do not forget to share this with your friends 👇

Click here to Subscribe for More Updates.

——– If you still have any concern regarding Amazon or any other Digital Marketing strategies, ASK THE QUESTION in the comments below ——–