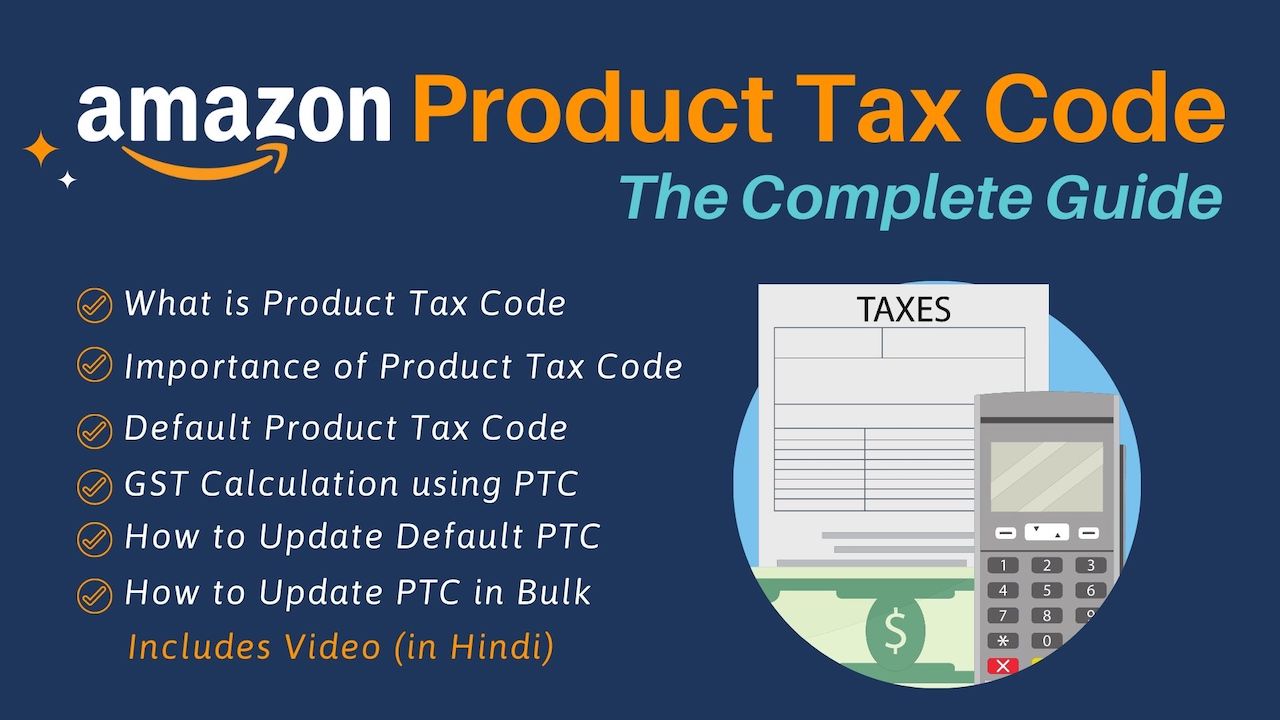

Are you wondering what is the Default Product Tax Code on Amazon? Before diving into what is Default Product Tax Code, it is important to understand what is Product Tax Code. So, in this article, I will talk in detail about Amazon Product Tax Codes along with complete PTC list, and its importance and relevance in calculation of your GST. I will also share ways to update PTC.

Table of Contents

What is Product Tax Code on Amazon?

As we all know, depending on the product or category of product, there is some GST applicable on every item that you sell as per government defined GST slabs.

In order to match the products listed on Amazon to their correct GST rate, Amazon has created certain codes that are called Product Tax Code or PTC. So basically, PTC Codes are Amazon defined codes that map onto government defined GST rates. You can think of them as GST Codes on Amazon.

Depending upon which product you are selling or in which category you are selling, you have to select a Product Tax Code or PTC.

Purpose or Importance of PTC

When you sell a product on Amazon, it deducts the GST applicable on your product. This is then automatically submitted to the government. And Amazon decides how much GST to apply on your products based on the GST rate that your selected PTC maps to.

In short, Amazon Product Tax Code defines what amount you will pay to the government as GST, for every product/service that you sell.

You can think of Product Tax Codes as Amazon GST Codes that it uses to calculate how much GST has to be charged on the products you sell. Thus, setting the right PTC means that you pay correct GST on your sales. Thereby, avoiding any tax or accounting related problems later.

Also, knowing and setting the correct Product Tax Codes on Amazon is important to ensure you are calculating your profit margins correctly.

What is Default Product Tax Code?

Default Product Tax Code, as the name suggests, is the product tax code that is applicable by default on all your products.

What does that mean?

Amazon allows you to set Product Tax Codes at 2 levels in your seller central dashboard.

- Account Level (mandatory)

- ASIN Level (optional)

Setting a Product Tax Code at account level is mandatory. And this PTC is applicable on all your ASINs or listings by default and thus Account Level PTC is called Default Product Tax Code.

Default Product Tax Code is the Product Tax Code selected by YOU at account level. It is not a predefined value set by Amazon.

If you do not set a PTC for individual listings (i.e. at ASIN level) then by default Amazon will use your Default Product Tax Code to calculate how much GST has to be charged for your product.

Product Tax Codes List and Corresponding GST Rates

Lets see the PTCs available on Amazon and their corresponding GST Rates

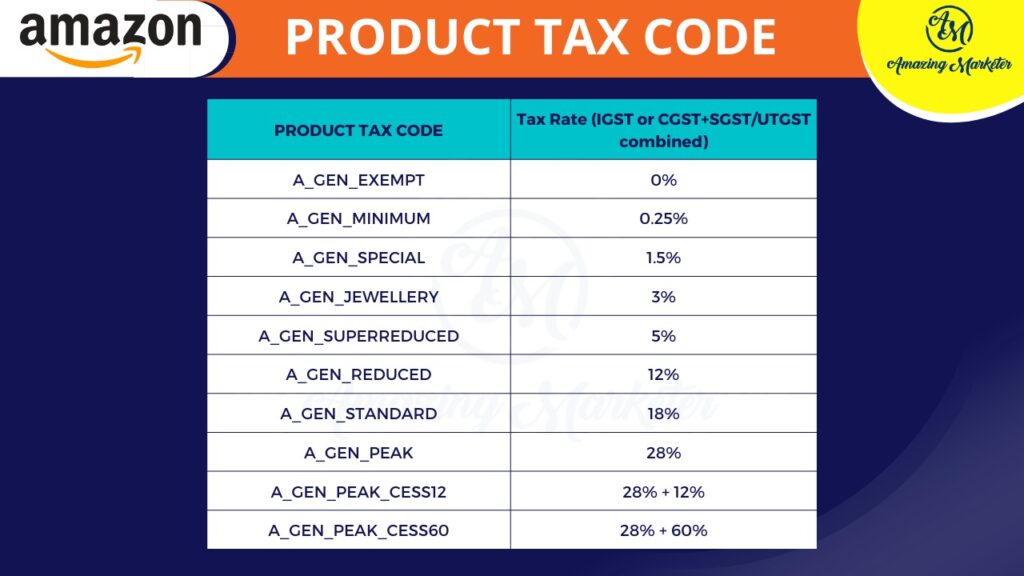

As of now, there are mainly 10 PTCs on Amazon as given in the table below:

Click on link below to Download this list for quick reference:

There are many more Product Tax Codes on Amazon that are very specific to the category of products you are selling. But as long as you are selecting the right Product Tax Code from this list, you do not need to worry about them. Even Amazon lists only these in their documents.

If you have any doubt regarding which Product Tax Code is applicable on your product, you can ask in comments and I will try to respond within 24 hours.

A_GEN_NOTAX vs A_GEN_EXEMPT – Which one to use?

A lot of sellers confuse A_GEN_NOTAX with A_GEN_EXEMPT and end up with unexpected results.

A lot of people select A_GEN_NOTAX as the PTC for their products assuming that No Tax or 0% GST will be applied on their products. However, that is not true.

If you are selling a product which is exempt from GST, you have to select A_GEN_EXEMPT. That tells Amazon, that your product is applicable for GST exemption so not to apply GST on it.

A_GEN_NOTAX does NOT mean 0% GST.

If your product is exempt from GST, select A_GEN_EXEMPT.

So, what does A_GEN_NOTAX mean?

If you select A_GEN_NOTAX, you are basically telling Amazon that you are not selecting any particular Product Tax Code (PTC) and Amazon is free to choose which PTC or GST Rate to apply. Amazon will then select a GST slab based on your product category, as per its understanding. This may or may not be correct.

Why it is a bad idea to select A_GEN_NOTAX as PTC on Amazon?

But as we already know, ultimately you have to submit the correct GST to the government. So, if Amazon has submitted less GST on your behalf and you priced your products or did profit calculations based on what Amazon was deducting, you will realize that you are actually left with lesser profit margin as you have to pay remaining GST to government.

If Amazon has submitted more amount to the government as GST on your behalf, then it is eating up on your profits and there is no way you can get a GST refund. It will only be adjusted against any GST amount you still owe to the government. And if you are a small seller, usually there is not much to offset. So, you again end up with lesser profit than was actually possible.

So, make sure to always select the right PTC.

Now lets see how Amazon calculates GST using these Tax Codes.

How Does Amazon Calculate GST using Product Tax Codes

When calculating how much GST Amazon will deduct for your product, you must remember 2 important facts:

- GST is calculated based on Product Tax Code selected by you, irrespective of actual GST Rate applicable on your product

- Selling Price set by you on Amazon is inclusive of GST

Lets discuss this one by one:

1. Amazon will Calculate the GST as per the Product Tax Code Selected by YOU

It means that it does not matter what GST rate is applicable on your product as per the government. Amazon will calculate GST based on the PTC that you have selected for that ASIN. And if you have not set the PTC at ASIN level, then it will use the Default Product Tax Code to calculate GST.

If GST rate applicable on your product, as per government, is 5% but you have set the PTC as A_GEN_STANDARD then Amazon will deduct 18% GST. This is because A_GEN_STANDARD corresponds to 18% GST Rate.

Also, if you have not set PTC at ASIN level, then it will use Default Product Tax Code for calculating GST.

Example:

Let say you have set the Default Product Tax Code as A_GEN_STANDARD (which means GST Rate = 18%).

Now, you list 2 products – A and B.

For product A, you select the Product Tax Code as A_GEN_SUPERREDUCED but for product B, you do not set the PTC in the listing.

So, 5% GST rate will be applied on Product A as A_GEN_SEUPERREDUCED corresponds to GST rate of 5%. However, for Product B, Amazon will use Default PTC of A_GEN_STANDARD and thus apply 18% GST.

But this does not mean, that you try to trick Amazon into deducting less GST by knowingly selecting the PTC with lower GST rate. Ultimately, you have to submit the correct GST to the government. Amazon is only helping you by doing that process directly for you.

Important Note:

Amazon will not check if you have updated the right PTC or are you paying the right amount of GST on your sales. But when you file your GST on the GST portal, you will have to use the correct GST rates to calculate the GST you owe to the government.

Now, if you have paid less GST earlier through Amazon, you will have to pay the remaining GST directly. And if you had done your profit calculations based on the GST Amazon was deducting, then you will end up lesser profit margin than you expected.

Another concern that arises here is that if the actual GST applicable on Product B was less (example 12%), then by not setting a PTC for Product B, you are paying extra GST than required on every sale.

So, it is extremely important to select the right tax codes for all your products.

2. Selling Price set by you on Amazon is inclusive of GST

The selling price that you select on Amazon for your listings, are inclusive of GST. i.e. GST is deducted from that selling price. Customer will not pay an additional GST on that price.

So whatever price you set for your products, Amazon will back calculate on that to figure out the GST and actual per unit price of the product. And the customer can see this break in the invoice that is given to them.

Below you can see a snipping of a sample invoice generated by Amazon:

Here, 599 is the total price that was set as the selling price by the seller.

So, always remember that GST will be deducted from the selling price that you set for your product and set the price accordingly.

How to Update Product Tax Code

Now that we know what is PTC/Default PTC and how important it is to update it, the next question that comes is – How to update the Product Tax Codes.

As we know, PTC can be updated at 2 levels – account level (as Default Product Tax Code) and at individual ASIN level. Lets see each of these in detail.

How to Update Account Level PTC (Default Product Tax Code)

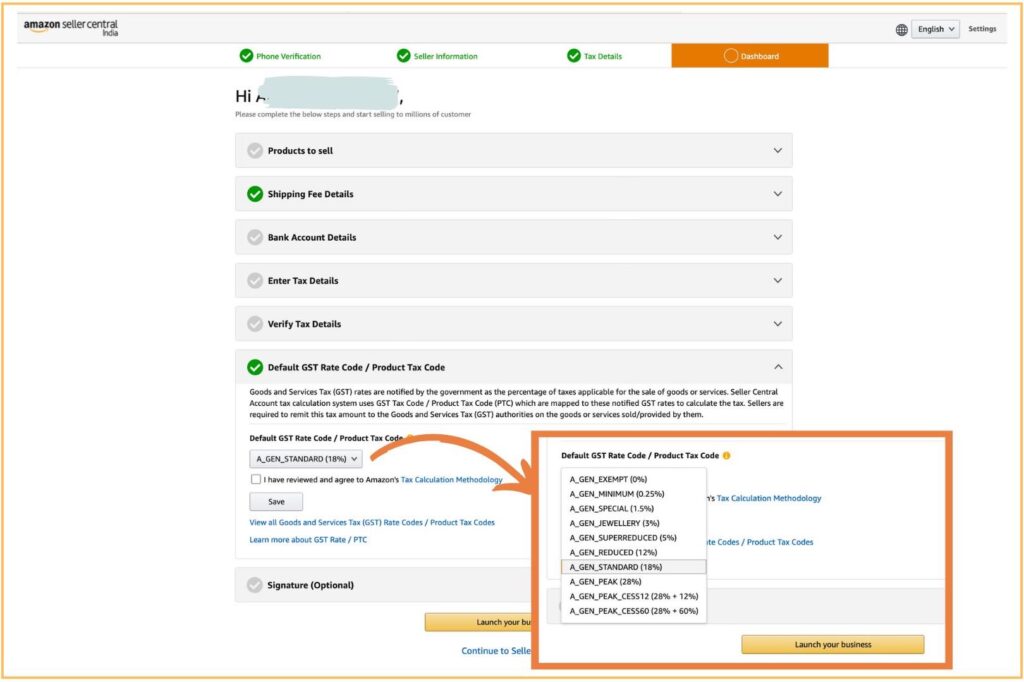

When you create your Amazon seller account, in the last step, Amazon asks you to complete your Tax and Account Related information. In this step, there is a section for Default Product Tax Code that you can set at the time of account registration itself.

If you did not set the PTC or entered the wrong PTC during Amazon Seller Account Registration, you can still update it later.

Follow the below steps to view or update the Product Tax Code (PTC) at the account level:

Step 1: Login into your Seller Central Account and go to ‘Account Info’ Page.

Step 2: Click on ‘Manage GST Details’

Step 3: On the ‘Manage Tax Details’ Page, open the ‘Additional Settings’ tab

Step 4: Here you will see ‘Default Product Tax Code (PTC)’. Locate and select the right PTC from the dropdown and click on Save.

This is it. Your Default Product Tax Code is now updated.

How to Update ASIN Level PTC

If you are selling products with different GST rates, then just setting the default PTC is not enough. You have to update it for every ASIN so that correct GST rate is applied on sale of every product.

You can do this in 2 ways:

- For every ASIN individually

- In Bulk.

Update PTC for individual ASINs

You can select the PTC when creating the listing. But if you have not done so, below are the steps to update it:

Step 1: Login into your Seller Central Dashboard and go to ‘Manage Inventory’ page.

Step 2: Click ‘Edit’ next to the listing for which you want to update the PTC.

Step 3: Select ‘All Attributes’ to enable Advanced View

Step 4: Go to ‘Offers’ Tab

Step 5: In the ‘Product Tax Code’ Box, select the correct PTC from the dropdown and click on ‘Save and Finish’

Udate PTC for ASINs in Bulk

If you have too many ASINs, then updating each and every listing individually can be a daunting task. But need not worry, you can update multiple ASINs in Bulk using the file upload method. Just follow the steps below:

Step 1: Go to ‘Add Products via Upload’ Page and download the Template File for your product category

Step 2: Copy the SKU Codes of all listings that you want to update in the SKU Field.

Step 3: Enter correct PTC in ‘Product Tax Code’ column for each SKU.

Step 4: In the ‘Update/Delete’ column, enter ‘PartialUpdate’.

Step 5: Upload the File

Watch Video in Hindi (With English Subtitles)

You May Also Be Interested In

——– If you still have any concern regarding Amazon or any other Digital Marketing strategies, ASK THE QUESTION in the comments below ——–

Note books par konsa gst slott and tax code aayenga

A_ELECTRONICS_GEN what wiil be tax for this code in amazon

Hi Karan,

Amazon has not listed anywhere how much tax is deducted for A_ELECTRONICS_GEN . However, it is based on applicable GST on electronic products.

I would suggest not to use such specific tax codes to avoid confusion and choose from one of the PTCs mentioned above in the article for better control over how much GST is deducted.

The gst charge on food items like biscuits and cookies are 8% but it haven’t listed here.

hi

we have listed our products, viz., Biogas Domestic Portable plants of various size.

it attracts 2 way GST codes, for the biogas plant its 12% (A_gen_reduced??)

whereas for shipping the same its 18% (transportation charges A_gen_standard ??)

how to put these 2 category GST in the single purchase/ bill

thank you

Hi Sorabh,

May i know how to view the updated product tax code for all my ASINS.

Is there a report that we can download which gives product tax code details?

Please advise

Thank you

Srini